Decoding the Disconnect: Wall Street vs. Main Street

Headlines read, “Interest Rates are Being Cut”. But why are mortgage rates up?

Why Some Borrowers Benefit from Fed Rate Cuts While Others Face Higher Costs

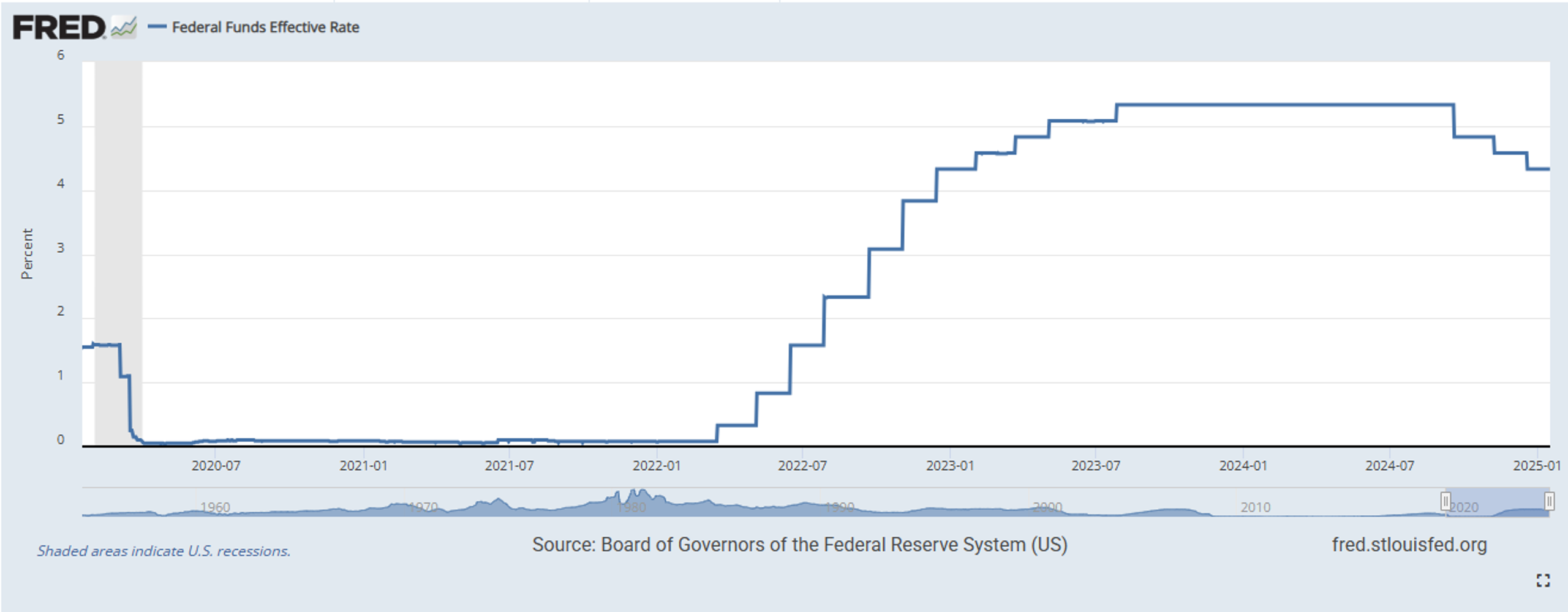

In September of 2024, the Federal Reserve started cutting interest rates. Headlines of financial publications proclaimed that interest rates were dropping. The Fed’s decision to lower short-term interest rates often signals relief for borrowers, but the impact varies widely depending on the type of loan, the benchmark rate it is tied to, the yield curve and the loan duration. Some buyers with short-term loans tied to the Secured Overnight Financing Rate (SOFR) are seeing lower borrowing costs, while others with loans tied to longer-term Treasury yields, like the 10-year Treasury, are finding their expenses elevated. This divergence reveals the complex dynamics of borrowing in today’s economic environment.

Short-Term Borrowers Reap the Benefits of Fed Rate Cuts

For borrowers whose loans are linked to SOFR, which closely follows the Federal Reserve’s short-term interest rate, the central bank’s rate cuts provide immediate relief. SOFR reflects the cost of overnight borrowing in the interbank market and is highly responsive to changes in the federal funds rate.

As the Fed reduces short-term rates to stimulate the economy, SOFR typically declines in parallel, lowering borrowing costs for those with floating-rate loans tied to this benchmark. This dynamic benefits commercial real estate investors and businesses with short-term loans or credit facilities, as their interest expenses drop almost in real-time.

For example, borrowers with bridge loans or construction financing pegged to SOFR have seen rate reductions that align with the Fed’s efforts to ease monetary policy. These lower rates improve project cash flow, enabling developers to allocate resources more effectively.

The decrease in SOFR has been about 1% year over year. That equates to annual savings of nearly $10,000 per million for SOFR-based borrowers.

Long-Term Borrowers Face Rising Costs

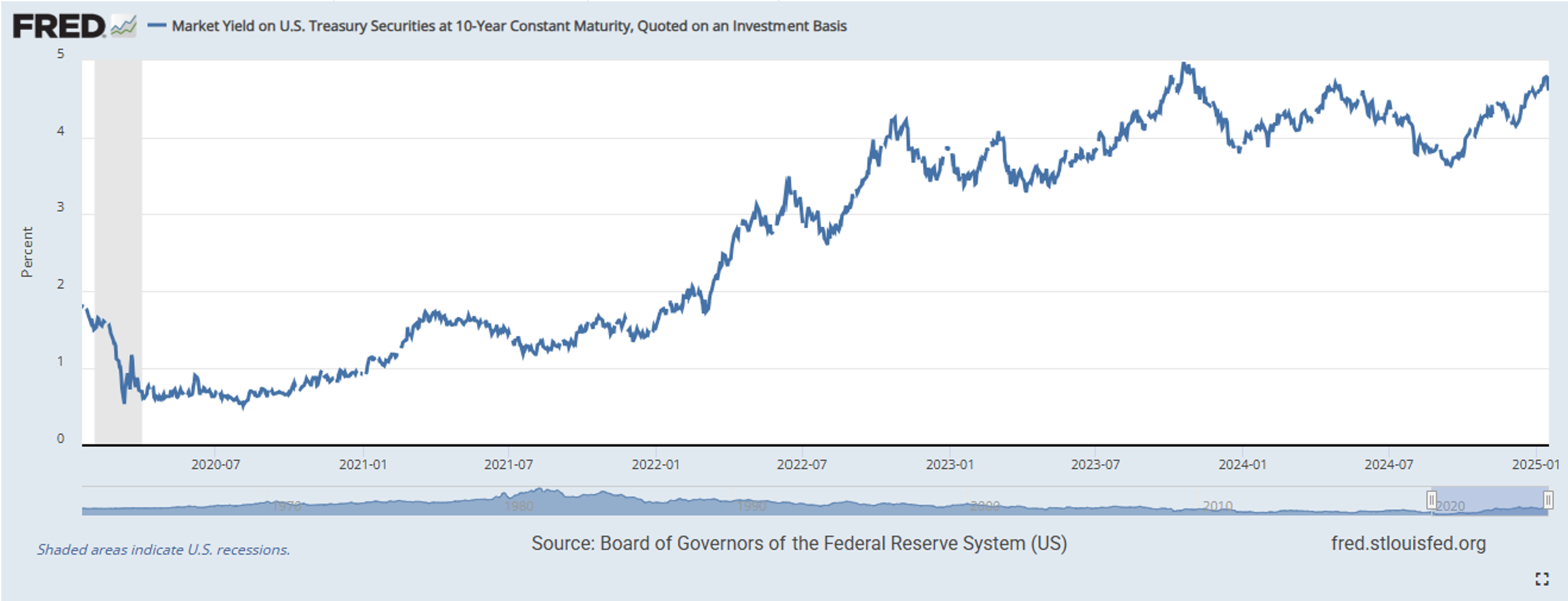

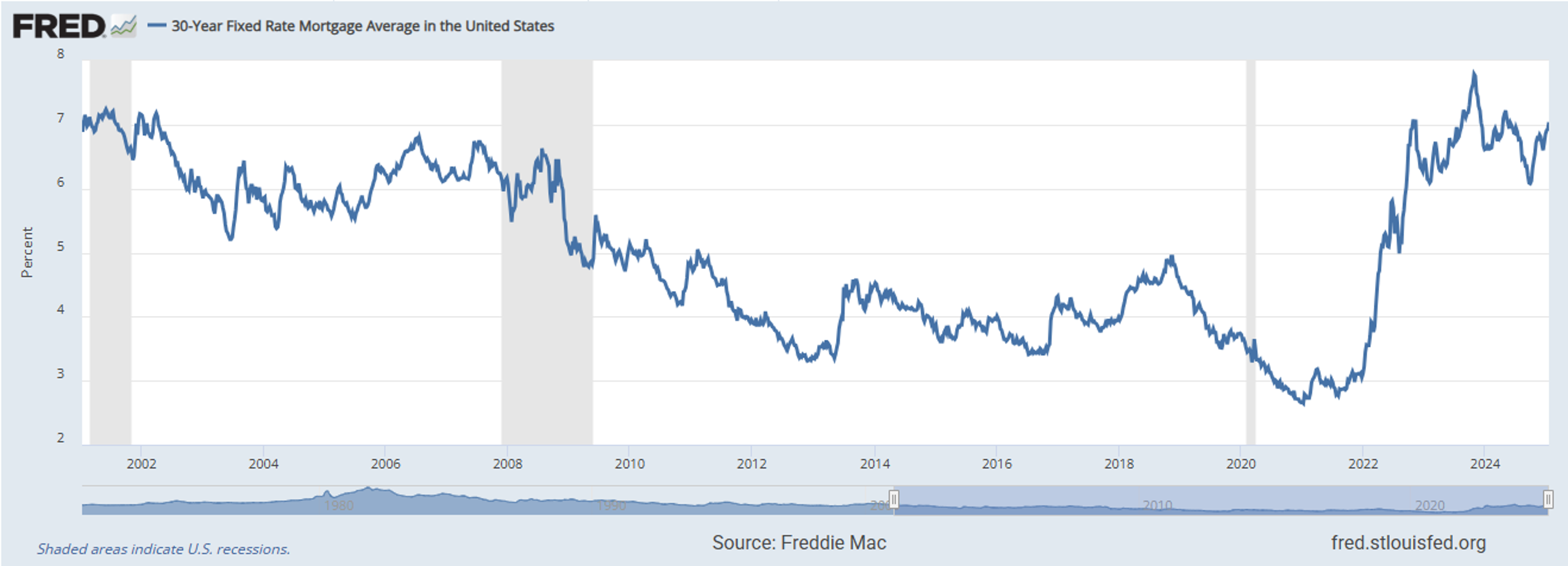

In contrast, borrowers with loans tied to longer-term Treasury yields, particularly the 10-year Treasury, are experiencing higher borrowing costs, even as the Fed lowers short-term rates. The 10-year Treasury yield is a benchmark for many fixed-rate mortgages and long-term commercial real estate loans.

While SOFR is down by 1%, the 10-year Treasury is up 0.50% (YoY) – an annual increase of $5,000 per $1 million borrowed.

Residential mortgage rates, which are derived from the 10-year Treasury rate, are flirting with a 25-year high.

The recent divergence between the Fed’s actions and the 10-year Treasury yield can be attributed to several factors:

Inflation Expectations:

Despite the Fed’s rate cuts, persistent inflation concerns have elevated longer-term rates. Investors demand higher yields on long-term bonds to compensate for potential erosion of purchasing power.

Economic Growth Concerns:

Long-term Treasury yields are influenced by global economic conditions, fiscal policies and market sentiment. In some cases, fears of sustained fiscal deficits or strong economic data can push yields higher, regardless of short-term rate trends.

Supply and Demand Dynamics:

A surge in government borrowing, particularly through the issuance of long-term Treasuries, increases the supply of bonds. If demand doesn’t keep pace, yields will rise to attract buyers.

Post-COVID:

Rates were low during COVID-19, via some government manipulation and an investor flight to safety. With the Covid crisis in the past, rates are beginning to normalize.

Why the Disconnect?

The key to understanding this divergence lies in the different drivers of short-term and long-term rates:

- Short-term rates are closely controlled by the Federal Reserve’s monetary policy decisions.

- Long-term rates, like the 10-year Treasury yield, are influenced by broader market forces including inflation expectations, investor sentiment and supply-demand dynamics in the bond market.

This means that Fed rate cuts don’t always translate into lower borrowing costs across the board. While the central bank can influence short-term rates directly, its impact on long-term rates is less predictable and often subject to external factors.

The Impact on Borrowers

This divergence creates a challenging environment for borrowers whose loans are tied to long-term rates:

Refinancing Woes:

Real estate investors looking to refinance properties at fixed rates linked to the 10-year Treasury are facing higher costs, squeezing margins and reducing profitability.

Higher Fixed-Rate Loan Costs:

New loans tied to long-term rates are more expensive, making it harder for borrowers to secure attractive terms for acquisitions or development projects.

For instance, a real estate investor financing a property purchase with a loan tied to the 10-year Treasury may face rates significantly higher than expected, even in a lower short-term rate environment.

Conclusion

While Fed rate cuts are designed to stimulate borrowing and economic activity, their effects are unevenly distributed. Borrowers with short-term loans tied to SOFR are enjoying the benefits of lower rates, while those tied to long-term Treasuries face higher costs due to market-driven factors. Understanding these dynamics is essential for borrowers navigating the complexities of today’s financial landscape. There are many factors to weigh when considering the financing of commercial real estate. Examples of such factors are asset type, age of the property, goals for the property, goals for ownership, stable vs development of the loan, swap hedges, interest rate caps or collars, slope of yield curve and credit availability.

Each transaction should be studied, in depth, to uncover the optimum strategy.

The principals at Proper have a combined 50 years of experience in the financial markets and have closed billions of dollars in real estate finance transactions. Contact Proper to help navigate your Commercial real estate finance journey.